- Bitcoin’s back-to-back “super signals” hint at explosive gains – last seen before a 10,000% rally.

- Over 94% of Bitcoin holders made profits as volume trends suggested strong bullish sentiment ahead.

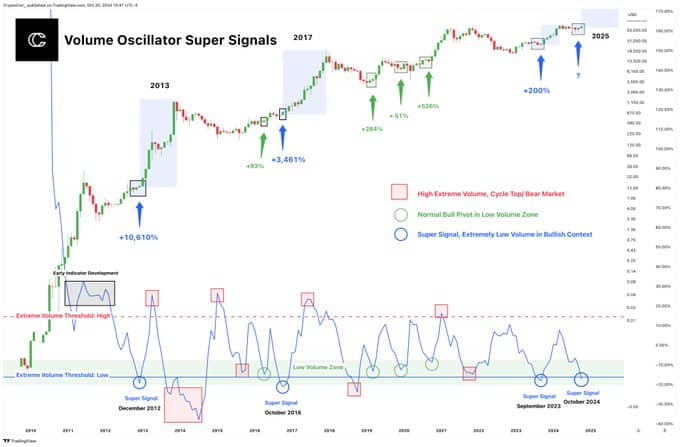

Bitcoin (BTC) The Volume Oscillator recently reported back-to-back “super signals,” a rare event that has only occurred during major bull runs.

Historically, such signals have preceded massive rebounds, including gains of over 10,000% in 2012 and 3,000% in 2016.

The latest event, observed in September 2023, follows a +200% rise in the price of Bitcoin, with another super signal appearing in October 2024.

Source:

The “super signal” occurs when trading volume is extremely low in a bull market. Analysts suggest that these conditions indicate accumulation, as sellers decrease while buying interest remains stable.

The lack of prior high volume spikes further supports a bullish outlook, differentiating this phase from low volume downtrends.

Bitcoin Price Gains and Market Data

At press time, the price of Bitcoin was $68,378.05, with a market cap of $1.35 trillion and a 24-hour trading volume of $24.5 billion.

This represents an increase of 5.96% over the last seven days, demonstrating consistent gains. The circulating supply of Bitcoin stands at 20 million BTC.

Open interest in Bitcoin futures increased 2.39% to $40.69 billion at press time, indicating increased trading activity and potential bullish sentiment.

CoinGlass data showed a 90.33% jump in trading volume to $42.62 billion, while options volume soared 182.07% to $1.60 billion.

Options open interest also rose 2.29%, now to $24.31 billion. The alignment of these metrics with Bitcoin price movements suggests growing optimism among traders.

Bullish sentiment

Data from IntoTheBlock showed that 94% of Bitcoin holders were making profits at current prices, signaling positive market sentiment.

The analysis also found that 71% of Bitcoin holders held their positions for more than a year, suggesting strong long-term holding behavior.

Meanwhile, 12% of Bitcoin’s supply was held by large holders, indicating a moderate concentration of ownership among whales.

Source: In the block

Additionally, there was a net outflow of $234.54 million from exchanges over the past week, indicating potential accumulation as investors move their assets into cold storage.

More than $105.29 billion in transactions above $100,000 took place over the past week, driven by institutional investors and large traders.

Read Bitcoin (BTC) Price Forecast 2024-2025

The geographic distribution of transactions is fairly balanced, with 54% coming from the Western regions and 46% from the Eastern regions.

Overall, the presence of super consecutives signals a unique event in Bitcoin’s history, creating anticipation of potential price movements similar to previous bull cycles.